Steward Partners Global Advisory is an employee-owned, full-service independent partnership, catering to family, institutional and multigenerational investors. Our professionals deliver full-service wealth management designed to meet the objectives of today's investors. Regardless of your investment goals or interests, each of our partners has the financial experience and specialized skills to address your specific needs.

We believe that clients, employees and partners deserve to be treated with the highest level of service. Steward Partners provides boutique-style, concierge-level service, customized wealth strategies and an exceptional client experience, delivered by our carefully selected advisors to a limited number of clients.

Headquartered in Washington, D.C., with 18 offices across the country (and counting), we're proud to offer a comprehensive range of financial management options, including wealth planning and investment strategy implementation, professional asset management services, private banking, institutional consulting, and international advisory and business solutions.

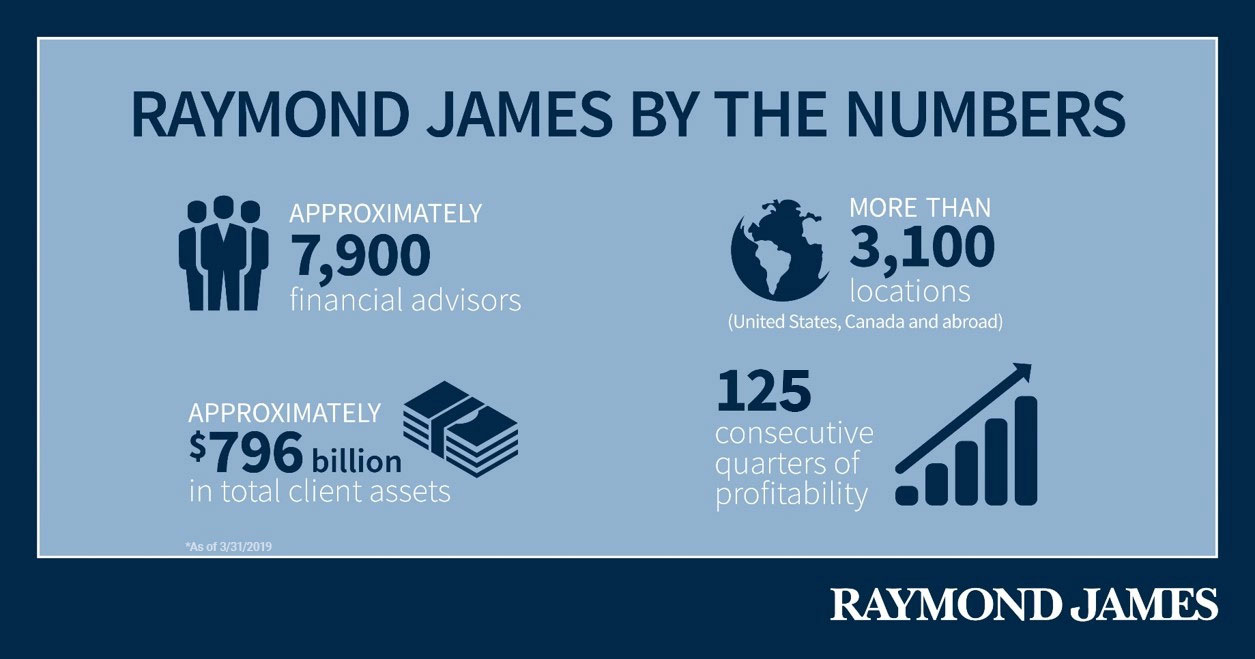

Our affiliation with Raymond James is another important part of how we serve our clients. Raymond James is one of the largest independent financial services firms in America, and helps support our business by providing access to leading investment research; surrounding our team with experts on a broad range of financial disciplines; offering operational and trading support to our team and clients; and enabling us to access market-leading technologies.

Through Raymond James, we are able to offer you access to the robust resources and sophisticated products of an international investment services firm while never compromising our ability to focus on what's most important: putting your best interest first.

We regularly work alongside our network of CPAs, attorneys, and other professionals to ensure all elements of our clients' financial world are working in sync. If you have existing professionals, we're happy to work with them as well or connect you with our relationships for a second opinion. Some of the areas we address coordinate and address include:

At Davis Executive Wealth Management, our partnership with BNY Mellon’s Pershing stands as a cornerstone of our commitment to your financial success. This collaboration empowers us to navigate the complexities of changing markets and regulations with finesse, ensuring we’re always positioned to maximize your wealth management and investment strategies. With the scale and strength of BNY Mellon, we’re equipped to enhance your portfolio’s profitability and catalyze business growth. Leveraging this partnership allows us to offer unparalleled financing, collateral management, and global trade execution services. Our focus is on providing you with a strategic edge in a constantly evolving financial landscape.

A growth strategy seeks to maximize capital appreciation of a portfolio over time by leveraging asset classes with high expected returns. It can include investments such as U.S. stocks, international stocks, variable annuities, real estate, and real estate investment trusts (REITs).

Preservation of capital is a conservative investment strategy where the primary goal is to preserve capital and prevent loss in a portfolio. It can include investments such as money markets, CDs, treasuries, immediate annuities, short-term bonds (taxable), and municipal bonds.

An income investing strategy seeks to maximize the annual passive income generated by the holdings. It can include investments such as CDs, intermediate/long-term bonds, tax-free bonds, government agency bonds, zero coupon bonds, preferred stocks, foreign bonds, growth and income funds, utility funds, equity income funds, and balanced funds.

With more than 25 years in the industry, Tim has performed every major role in the practice, from fund selection to performance analyses. As the founder and CEO of Davis Executive Wealth Management, he oversees business development for the practice and continually builds new relationships with clients. He specializes in asset allocation and management, and his goal is to help successful executives and business owners maximize their wealth for growth and security. He’s witnessed the truth of the adage, “Concentration creates wealth; diversification preserves it,” and he helps clients safeguard newfound wealth by balancing their portfolios in such a way that leverages their company stock opportunities without creating an unbalanced reliance on it. As one of the first financial professionals to write a 10b5-1 plan, he has vast experience navigating complex compensation plans, and he’s adept at helping executives design stronger, more stable plans.

As Davis’s acting COO, there isn’t much that doesn’t pass through Michaelyn’s hands. In addition to conducting client reviews and meetings alongside Tim, she oversees all the financial planning and manages internal workflow for the practice. With her superior organizational skills, she makes sure everything is in the right place at the right time for both our clients and our team members. Some of her duties include preparing documents for meetings, maintaining client reports, managing clients’ cashflow, organizing our calendar, and educating clients about their planning strategies. She takes pride in the fact that nothing goes unnoticed or forgotten within the practice, and she strives to complete every task with efficiency and excellence.

Michael is a highly skilled advisor who specializes in investments and custom portfolio development. He works closely with clients to identify strategies that are designed to help them achieve their goals and cultivate enduring growth. Communicating consistently throughout the planning process, he helps clients recognize the power and purpose behind each step of their plan, and in doing so, provides valuable clarity and context about their financial futures.

Michael also oversees our portfolio management program, and he thrives in our firm’s fast-paced, dynamic environment. Our team is constantly monitoring the markets and making proactive adjustments to position our clients’ discretionarily managed portfolios, and to support this process, Michael spends ample time researching, reading industry papers, and partaking in research groups. His goal is to stay up to date on industry news so he and the team can react strategically on behalf of our clients.

The individuals mentioned as the Portfolio Management Team are Wealth Managers with Steward Partners participating in the Steward Partners Portfolio Management program. The Portfolio Management program is an investment advisory program in which the client’s Wealth Manager invests the client’s assets on a discretionary basis in a range of securities. The Portfolio Management program is described in the applicable Steward Partners ADV Part 2, available at https://adviserinfo.sec.gov/Firm/283004 or from your Wealth Manager.

With over 25 years in the industry, Ed is passionate about serving clients with care and ensuring their planning experience is just as fun and comfortable as it is efficient. Like the rest of the team, he does everything in his power to serve our clients with excellence. His creative problem-solving skills, extensive industry knowledge, and vast experience make him an invaluable asset to the practice. He takes pride in supporting clients through life’s ups and downs, and his warm and personable nature creates an atmosphere where people feel genuinely valued.

Jimmy supports our team in a variety of ways, and some of his duties include opening and maintaining client accounts, distributing and transferring funds to client accounts, business development, and managing the day-to-day tasks related to financial planning. He appreciates that every step in the process plays a vital role in the client’s plan, and his goal is to provide timely, comprehensive support for our advisors so they can serve our clients in a more effective, powerful way.

Managing another person’s livelihood is a serious responsibility, and it’s one he doesn’t take lightly. Whether he’s answering questions about their accounts or transferring funds for clients, his goal is to be a reliable, trustworthy resource for them. Ultimately, he hopes to simplify their lives and relieve the pressure of wealth management so they can spend more time enjoying life with their friends and families.